The Industry

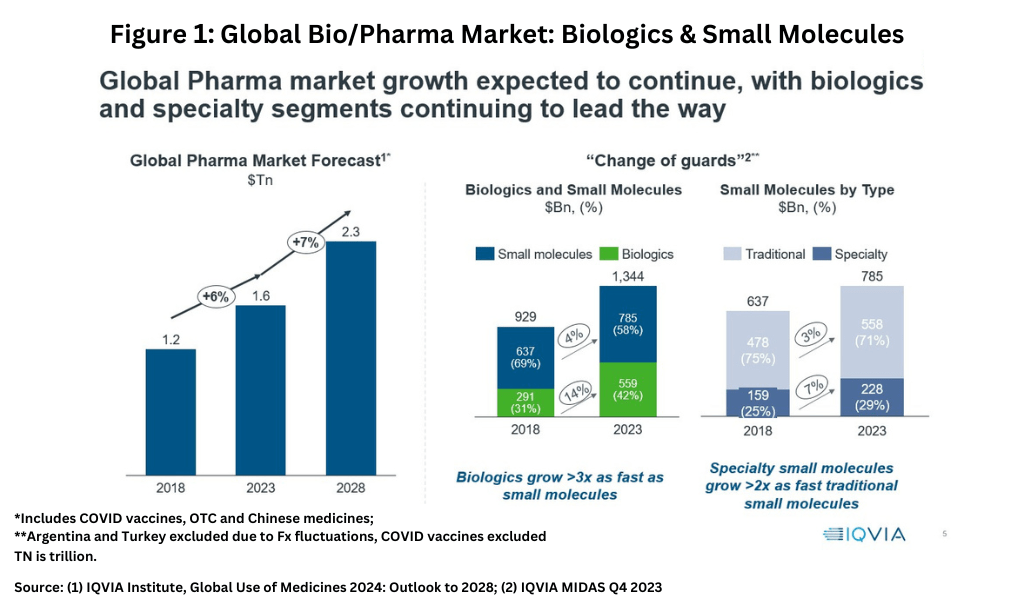

Biologics and speciality small molecules are growing faster than traditional small molecules with the Small Molecules/Biologics market share shifting from 69/31 in 2018 to 58/42, as per an IQVIA report. Between 2019 and 2023, the share of small molecules in new drug approvals has been 79%/75%/72%/57%/69%. In 2023, there were 55 new drug approvals of which 38 were small molecules. Of these approvals, 20 were "first-in-class" and 17 out these 20 were small molecules. More than half of these first in class approvals were for rare diseases/conditions. The biologics market is expected to grow at double the pace of small molecule's in next 5-6 years.

The outsourced API market is experiencing significant growth and structural shifts. Currently, outsourced APIs make up half of the global API consumption and are projected to grow faster than captive API setups, at 7% annually between 2023 and 2030, compared to 4% growth for captive setups. This growth is driven by cost benefits from economies of scale, the presence of low-cost manufacturing hubs in India and China, and rising demand for generics. While China currently holds a 35% share of the outsourced market, primarily in high-volume, less complex APIs, there is a move to diversify supply chains away from single sources. It is predicted that China’s share of the outsourced market is expected to decline by approximately 10 percentage points from 2023 to 2030, stabilising around 15% by 2047. India's API exports are currently around $4 billion, compared to China's $40 billion, and could reach $12 billion by 2030 and $80-90 billion by 2047.

Impact on Indian Pharma

The Indian Pharma industry accounts for 20% of global generics supply but only 3% of the Pharma exports value share. For Indian pharmaceutical companies, the BIOSECURE Act and the "China+1" supply chain diversification presents a significant opportunity to increase its position in the value market share as well. While the Biosecure Act still is stuck in the power corridors for now, it has accelerated the China+1 effors by the Big Pharma. While India already has a presence in the small molecules space, it needs to grow its presence in the biologics space.India stands to benefit significantly from the Biosecure Act and the China + 1 strategy due to a confluence of factors, including its established pharmaceutical manufacturing capabilities, a skilled workforce, and a growing focus on innovation. The Biosecure Act and the China + 1 strategy enhances India’s prospects.

Potential

- API Exports: India's API exports are currently valued at around $4 billion, compared to China's $40 billion. However, this also highlights a massive opportunity for India to grow its API exports. India is poised to capture a substantial share of the API market from China, potentially reaching $12 billion in API exports by 2030 and $80-90 billion by 2047. This growth is contingent on India making adequate infrastructure investments. Some analysts believe that Indian API revenues could potentially triple or quadruple in the next 10 years.

- CDMO/CRO Exports: The Indian CDMO market has doubled since 2019, reaching $20 billion in 2023. India's CRO market has also seen substantial growth, reaching $2.5 billion in 2023. India’s CDMO and CRO exports are projected to increase from $18 billion in 2023 to $44 billion by 2030 and $150-155 billion by 2047. India is expected to become a critical hub for pharmaceutical outsourcing. It is predicted that India will surpass China in small molecule CDMO exports by 2030, and reach parity in large molecule CDMO exports by 2047.

- Biosimilars: The Indian biosimilars export market is expected to reach $4.2 billion by 2030 and $30-35 billion by 2047, following a similar trajectory to generic formulations with a lag of nearly a decade.

The China Challenge for Indian Players

The Indian Pharma industry relies heavily on imports from China. In FY24, >70% of intermediaries and bulk drugs were imported from China (FY21: 66%). The China+1 strategy would only come to fruit if supply chain dependency on China is reduced and not layered. Indian Pharma companies need to create a China independent supply chain which will come at the cost of margins. Indian generics manufacturers import most of the APIs from China instead of manufacturing it because China can manufacture it for cheaper.

What Companies Are Saying

Most companies acknowledge a shift in the industry towards diversifying supply chains and reducing reliance on China. The Biosecure Act is seen as a potential catalyst, but the underlying drivers appear to be broader, including supply chain resilience, risk management, and lessons learned from the COVID-19 pandemic. Many companies are seeing increased interest and activity from clients looking for alternatives to China and they are positioning themselves to capitalise on this trend. Here are a few takeaways:

Neuland Laboratories

- Biosecure/China+1:

- Neuland management notes a heightened level of customer visits, requests for information (RFIs), and meeting requests from US pharma and biotech companies, which they consider lead indicators of a shift away from China.

- They believe that US companies are looking for alternatives to China, whether or not the Biosecure Act is implemented as currently drafted.

- However, Neuland cautions against expecting a dramatic increase in new business, as it remains to be seen how much and when this business will materialise.

- Neuland management indicates they are closely monitoring market activity rather than getting carried away by press regarding the Biosecure Act. They are engaging with customers to understand their preferences.

- They acknowledge that China has invested heavily in technology and large-scale manufacturing, whereas Neuland has focused on capability development, technology and IP.

- They don't expect to compete with China on every molecule, but rather on specific molecules.

- Neuland has seen business shifting from China, where price is not always the key consideration but technology, capacity needs or batch size requirements are important.

- Growth Outlook:

- Neuland is observing a potential shift of business from China to India, regardless of whether the Biosecure Act is fully implemented. They acknowledge that the extent and timing of this shift remain uncertain.

- They are a pure-play API company, and therefore, their observations on the impact of the Biosecure Act may differ from clinical or med-chem focused CDMOs.

- Neuland has seen a lot of new biotechs coming and engaging with them, partly because of the improved funding environment in the US and also with a sense that there is a little bit more of a tailwind towards India in the China versus India narrative.

- They note that some projects have moved from a Chinese CDMO to Neuland.

- Neuland is focusing on building a specialised API business, and is cautious in creating capacity, preferring to have specific demand before expanding, rather than creating large facilities and then seeking customers.

- Neuland is thinking about capacity requirements 3 to 5 years into the future.

- Capex:

- Neuland is cautious in creating capacity and prefers to create capacity in anticipation of specific demand, rather than creating a very large facility and then looking for customers.

- They are thinking about capacity requirements for 3 to 5 years into the future.

Laurus Labs

- Biosecure/China+1:

- Laurus Labs has seen a lot of customer interest in engaging with them, particularly for large volume projects, but not so much for early-stage (preclinical and Phase I) projects.

- They are not seeing any decreased interest in supply chain diversification despite delays in the Biosecure Act.

- Laurus states that they are working on their strategy regarding facilities and products and may provide more details in the middle of the next financial year.

- Growth Outlook:

- Laurus is working on a strategy to identify niche, large volume products, where India hasn't played a big role so far.

- They expect to deliver better results in H2 and in the next financial year, and also expects to see growth in the CDMO division.

- Laurus expects to see growth from their generic API business, and also from integrated offerings with formulations.

- Capex:

- They are investing in manufacturing and packaging lines for CMO (contract manufacturing) for integrated generic contract manufacturing, with results expected in Q1 FY26.

- A significant portion of their capex from FY22 to FY25 is still not commercialised

Syngene

- Biosecure/China+1:

- Syngene's management views the Biosecure Act as a potential "cherry on top," rather than the core driver of business. They emphasize that the shift is more about pandemic learnings, COVID supply chains, structural rebalancing and risk management.

- They note that clients are looking for resilience, flexibility, and dual sourcing, and they are positioning themselves as a China-independent supply chain option.

- They have observed that the change in wording around the implementation timeline of the Biosecure Act has lessened the urgency, but not the overall direction of companies looking for alternatives to China.

- Syngene indicates that the trend is playing out in increased client visits, audits, and pilot projects.

- Syngene management believes that big pharma companies tend to be slow to change, but when they do, they do so with real purpose and they expect this movement away from China will happen over the next 2, 3, 4, or 5 years.

- They state that they are seeing increased interest in discovery, development, and manufacturing across both large and small molecules.

- They have also pointed out that there is a lot of private equity capital on the hunt around the world for companies that will benefit from the China Plus One story.

- Capex:

- Syngene invested approximately US$34 million in CAPEX over the first nine months, with 50% in research services and 25% in biologics, to upgrade Unit III, the manufacturing facility acquired last year.

- CAPEX spend for the quarter was USD 12 million, with a large share allocated to research services and expanding facilities in Hyderabad.

- The biologics manufacturing facility acquired last year is on track to start operations in the second half of the current financial year.

- They have sufficient headroom for growth in terms of capacity, infrastructure and people.

Piramal Pharma

- Biosecure/China+1:

- Piramal Pharma's management believes that recent changes in regulations along with the need for supply chain diversification are expected to provide medium to long term growth opportunities for CDMO companies and they are preparing to capitalize on this.

- They acknowledge that the Biosecure Act has not yet passed but, if companies are looking to diversify their supply chains, Piramal has capacity available both in the US and India.

- Piramal Pharma believes that the benefits of their global structure is that they have capacity available in the US for US manufacturing as well as in India.

- They believe that the integrated program makes their business stickier and a single win can have a larger ticket size and is more durable when they perform.

- Growth:

- Piramal Pharma sees a need for customers to diversify their supply chains. However, customer decision making remains prolonged.

- They have seen customer interest, in light of the Biosecure Act, but also a degree of uncertainty.

- Piramal Pharma has capacity in both the US and India, which allows them to benefit from supply chain diversification.

- They are seeing a return to growth in the generic API segment, after a few years of volatility.

- They are seeing healthy growth in their CDMO business, which is driven by commercial manufacturing and generic API.

- Piramal is also expanding capacity, including in high potent API and ADC facilities.

- Capex:

- Piramal Pharma is making calibrated investments in their CDMO business, geared towards customer preferences for integrated services, especially in areas like ADCs, peptides, and on-patent API development.

- They have announced a strategic investment of $80 million to expand their sterile fill-finish facility in Lexington, which is expected to be commercialised by the end of FY27. This expansion will more than double the plant's current capacity and is customer-led.

- They are putting up new manufacturing lines of Sevoflurane in the Digwal facility, and increasing KSM manufacturing capacity at the Dahej site.

- Piramal is expanding capacity in high potent API and ADC facilities.

OneSource Specialty Pharma

- Biosecure/China+1:

- OneSource notes that they are seeing an increase in visits from innovator companies, including American, Japanese, and biotech companies and they have multiple RFPs open.

- They state that their unique position in biologics is that they have an integrated biologics drug substance and drug product site.

- OneSource management indicates that most of the first generic filings are housed out of their plant and that they believe they will have an important share of the market formation of generic GLP-1s.

- They also believe they are in a strong competitive position due to their capacity, capability and compliance track record.

- Capex:

- OneSource plans to invest about $100 million in CAPEX over the next 2 to 4 years. A significant part of this will go towards their drug-device combination capacities, but they will also add new capabilities in their Strides injectable space. OneSource is proactively expanding capacities to ensure they can meet customer demand.

- They are planning to increase their capacity from 40 million to 220 million in the next 3 to 4 years, and the majority of this capacity is spoken for.

- They are one of the few manufacturers producing GLPs under an isolator system, which requires long lead times on equipment.

- They expect a significant portion of the capacity to come online in FY26.

This is not an exhaustive list and there are other players also with a presence in the CDMO/CRO space such as Divi's, Suven.

Further Reads:

Read: https://gubbagroup.com/how-will-biosecure-act-impact-indian-pharma-companies-aditya-khemka-explains/

Read: https://www.biospace.com/opinion-chinese-cdmos-and-us-biopharma-pr-strike-a-precarious-balance

No comments:

Post a Comment