XIRR and CAGR are fancy terms which ultimately tell you how much returns you are making on your investment. XIRR is used for SIPs or investments where there is periodic cash outflow and CAGR is used when there is a one time investment.

Absolute returns are like the total score in cricket. India scored 250 in 50 overs. CAGR / XIRR is like the run rate. India scored 5 runs per over. Your investments might have grown 100% - great! But have they grown 100% in 10 years (CAGR: 7%) or in 3 years (CAGR: 26%). But why am I talking all this?

|

| Time can tilt returns |

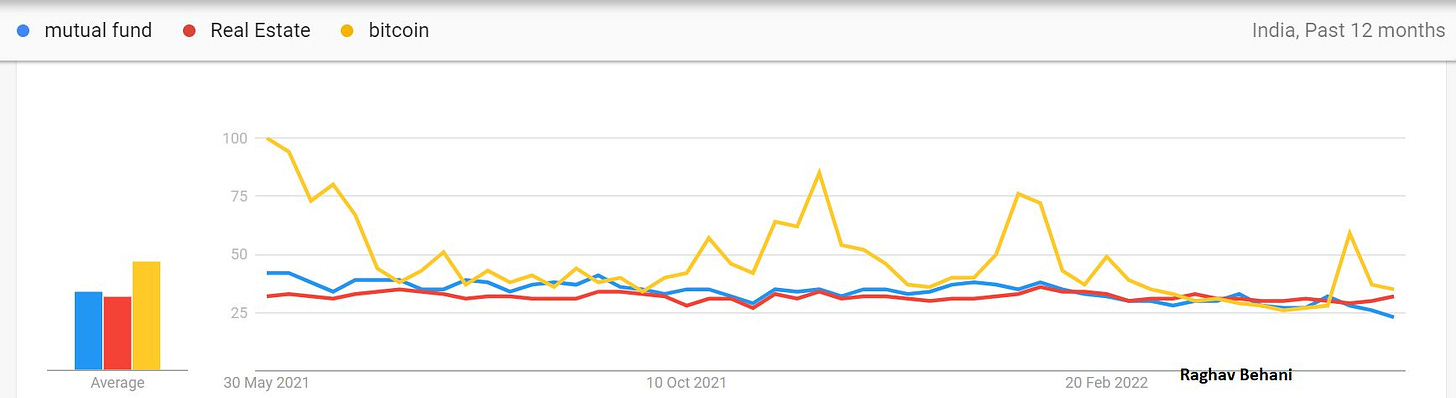

A lot of new investors started investing through SIPs in Mutual Funds in the last 2-3 years and while the initial euphoria showed them XIRR of 25%-30% and more, they felt good! A few of them probably knew that the returns would normalize to ~12% to 15% over the long term but even they couldn’t gauge what that normalization would look like. In just 6-7 months, the SIPs have gone from an XIRR of 25% to an XIRR of -15% and so has the sentiment. A simple analysis of the google search trends shows that the interest in volatile assets such as MFs and Cryptos has come down while that of real estate has gone up! Seasons change…

|

| Google search trends for mutual funds, real estate and bitcoin |

So, why is XIRR misleading?

Well, for starters - vintage. How long have you been investing? If just 2-3 years then prepare for XIRR to be volatile. If for 10+ years then XIRR can be stable.

Lets take the case of 3 investors. One started investing in 2010, the other in 2015 and the last in 2020. They’ve invested Rs 10,000 per month and earned an XIRR of 15% p.a. How much has each made till now?

Now imagine the market falls and this fund NAV is down 20%, will the XIRR that each investor is making remain the same?

|

No. The XIRR will not remain the same even though the pre-crash XIRR is same, NAV is same for all and the fall in NAV is also same for all!

|

| The XIRR before and after the crash |

The investor who started 2 years back saw their XIRR come down from 15% to -9%

The investor who started 7 years back saw their XIRR come down from 15% to 9%

The investor who started 12 years back saw their XIRR come down from 15% to 12%

In short, the longer you invest the more stable the XIRR gets. Keep reading for a better example.

|

| Only Sarabhai vs Sarabhai fans get this |

Assume Team India has scored 240 runs in 40 overs (Run rate: 6 per over) and then there is a maiden over, the run rate falls to 5.85. However if there was a maiden over when Team India was at 30 runs in 5 overs (Run rate: 6 per over), the run rate would have fallen from 6 to 5!

So, do not get excited / disappointed with your returns from SIPs in Mutual Funds in the initial years. Also, can you please check out my YouTube channel?

No comments:

Post a Comment