AMCs are rushing to introduce new funds and ETFs which give Indian investors exposure to international stocks. In this post, we analyze the multiple ways to get this exposure, existing schemes, the inherent risks and potential rewards, and the taxation of these funds and ETFs. Some advisors and financial planners advocate for a 15% to 20% exposure to international stocks for diversification. At the end of the post we also highlight some funds that investors can track and further research.

The case for international stocks & geographical diversification

Although 20% to 25% of Nifty 50 revenues come from exports, a fall in domestic revenues won’t cushion share price performance. American companies derive revenues from exports to different countries and also from a large domestic market. Chinese companies contribute significantly to the global supply chain apart from their domestic market’s consumption.

Geo-politics, domestic issues in every country, differential economic growth rates, innovation and future potential of each region make up a case from international diversification. India might be going through a slow growth phase but China and USA may be growing fast. India might grow fast between 2022 and 2025 but the larger economies might see tapering growth rates! Currency depreciation also adds to the returns that international funds can deliver to Indian investors. If you invest when $ is at 75 and withdraw when $ is at 85, you would have earned around ~ 13.3% simply from the currency depreciation!

Indian markets don’t allow exposure to new age companies like Facebook, Apple, Netflix, Google, Amazon, etc. Investors would want to benefit from these futuristic companies.

Risks: Tax structures, high expense ratios, currency risk. What if $ slipped from INR 75 to INR 65? The value of your $ investments will go down!

SEBI’s guidelines

The Asset Management Companies have to follow monetary limits in their international funds.

- On a macro level, the entire mutual fund industry in India can at most invest $7 Billion in international stocks

- Each mutual fund house can invest $600 Million in international stocks

- For international ETFs, the industry limit is $1 Billion and per mutual fund limit is $200 Million

Taxation of international funds and ETFs in India

International funds are taxed as debt funds. Meaning, if you book profits before 3 years, you pay a short term capital gains tax of 15%. If you book profits after 3 years, you pay long term capital gains tax at 20% with the benefit of indexation.

Domestic equity funds are taxed at 15% if profits are booked in less than a year and at 10% above Rs 1 Lakh if profits are booked after 1 year. This tax structure makes domestic funds a little more tax efficient than international funds.

How to add the international flavor to your portfolio?

Via domestics funds:

An Indian investor can add the international diversification and still use the tax structure of domestic equity funds. How? Simple. Invest in equity schemes that primarily invest in Indian equities and have some international stocks too! Some examples are: PPFAS Flexicap, Axis Growth Opportunity, Kotak Pioneer Fund, etc.

These funds have exposure to international stocks ranging from 30% to 35% of their portfolio and in a way give the investors the required diversification. The downside is that you have no control on the sectors and countries the fund manager will invest in.

Via pure play international funds:

You can invest in funds and ETFs that primarily invest in equities of a given region / country / sector. You can even choose to invest in the indices of other countries like S&P500, NASDAQ 100, etc. Your investments via this route will be taxed as debt funds.

While some funds invest in international stocks directly, other funds act as feeder funds and invest in other funds and ETFs only and not in stocks directly. Keep reading to understand…

Are these funds and ETFs expensive?

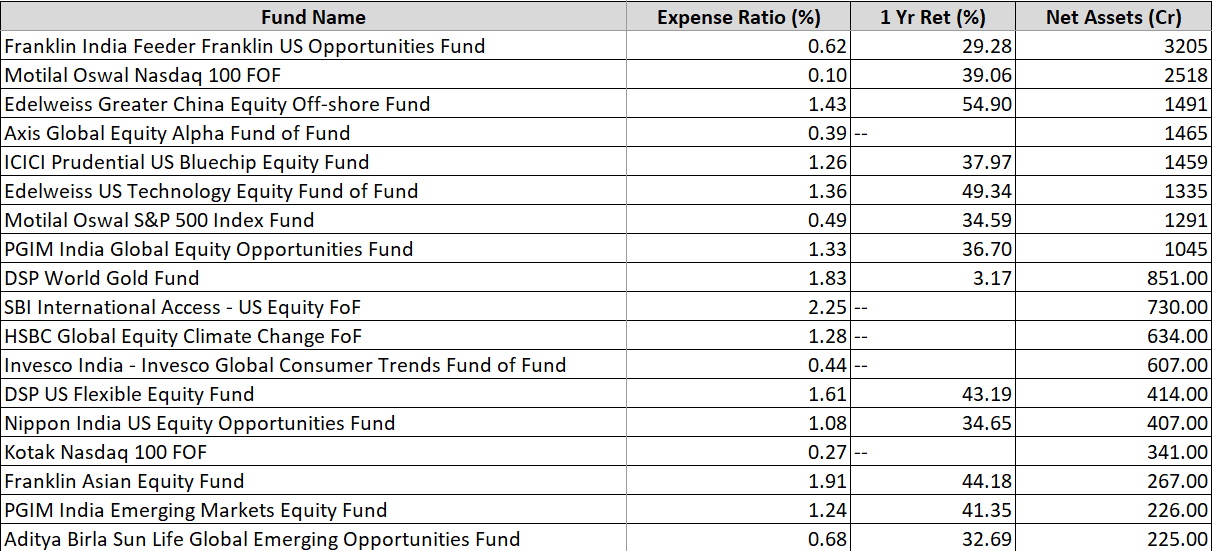

Yes, these funds are expensive. Infact, there is an element of double charge in few of the international funds. For example, the Edelweiss Greater China Fund has an expense ratio of 1.43% in its direct plan. However, investors need to keep in mind that the fund actually invests in JPMorgan Funds - Greater China Fund which in turn charges investors with a 1.5% management fee.

The index funds like Motilal Oswal S&P 500, MOSL Nasdaq 100, Mirae Asset FANG+ ETF, etc. have lower expense ratios than the feeder funds or fund of funds.

International funds to track

I believe that USA and China should be the preferred diversification options for Indian investors. Both these countries have resilient economies and lead globally in innovation and also giving the world next wave of wealth creating companies like Alibaba, Amazon, etc. Europe, Japan and South Asian countries can come next. There are even funds which give you a chance to invest in the emerging markets theme.

Funds with exposure to USA:

MOSL S&P 500 fund

MOSL Nasdaq 100

Mirae Asset FANG+ index fund

These funds give you exposure to America’s bluechip index and technology stocks. Given the low expense ratios, these make a good addition to the portfolio.

Funds with exposure to the China:

Edelweiss Greater China fund

Edelweiss emerging markets opportunity fund

Here is a list of international funds with AUM > Rs 200 Crores.

So what are your views on international diversification for a retail investor in India? What regions / themes would you choose for investing in to diversify?

No comments:

Post a Comment