In this post, we discuss ABB Power Products (NSE: POWERINDIA) which is not a new business but with a major change in corporate and business structure, is expected to clock high revenue growth rates. The power grids market presents an opportunity because of increasing adoption of renewable energy, electric vehicles, storage batteries, etc.

ABB & Hitachi’s deal

ABB is a Swiss company operating in the automation, power, robotics and heavy electrical equipment space. Hitachi is a Japanese conglomerate operating in power and heavy electrical equipment, amongst many other business verticals. In December 2018, ABB Ltd. announced the divestment of its power grids business into a JV in which Hitachi would be a majority stake holder (~80.1%). Hitachi paid $6.85 Billion for this acquisition in July 2020. Hitachi has an option to make the JV a wholly owned subsidiary in 2023.

Back home in India, ABB Power Products and Systems India Ltd. (APPSIL) was demerged from ABB India in Feb ‘19 and the Hitachi-ABB JV became the promoter, with a 75% stake.

- ABB’s power grid business made more than $10 Billion in revenues in 2019 and employed 36,000 people globally.

- The enterprise value at the deal price worked out to $11 Billion.

- The deal was valued at 1.02x revenues and 11.32x EBITA (2017)

ABB power grid was strong in utilities, industries and infrastructure. Hitachi had a strong presence in mobility, data center and smart city projects. Both companies together with Hitachi’s LUMADA digital platforms have a chance to unlock synergies in terms of high revenue growth rates through long term client contracts and cross selling of different products and services across the value chain of the power distribution sector.

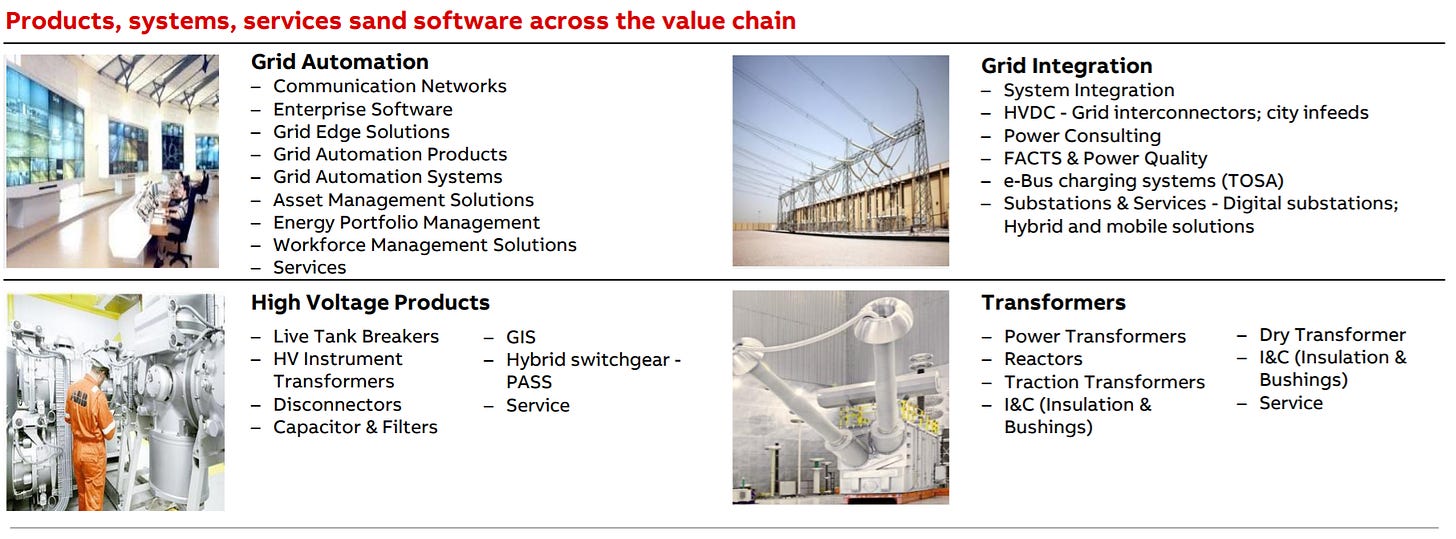

The company’s four business lines are Grid automation, Grid integration, Transformers and High voltage products. APPSIL’s provides products, system, software and service solutions across the power value chain. Products contribute ~ 78%, projects ~ 17% and services ~ 5% of the revenues respectively. The company makes 15% to 18% from exports but plans to increase the share of exports to ~ 25% of revenues.

- The company’s main products are high voltage products and transformers. 1 in 4 high voltage switchgears in the world are from Hitachi-ABB. Renewable sources of energy are often generated far away from where they are consumed. This requires smarter HVDC grid connectivity systems. APPSIL manufactures products like GIS, transformers, switchgears, digital substations, etc.

- On the service side, APPSIL helps digitalize the power assets and create smart connected grids. APPSIL expects to capitalize on Hitachi’s digital solutions capabilities and LUMADA IOT platform. Through these services, APPSIL helps clients reduce manual intervention and costs associated with running power systems.

|

| The 4 business lines of APPSIL |

What are the avenues of growth for APPSIL?

The company stands to benefit from a growing demand for smart grids. The tailwinds for this sector come from the following sources:

- Growing market for renewable energy (solar and wind)

- Electrification of railways and phasing out of diesel locomotives

- Expansion of metro network and mass rapid transit systems in urban cities

- Growth of data storage centers in India

- Growth of electric vehicles and demand for charging stations

- Outsourced orders from holding company

A Japanese promoter group gives APPSIL significant advantage over Chinese competitors in India, on account of current geo-political sentiments. The company stands to benefit from infra spending on 100 new airports, Delhi-Mumbai expressway, etc.

To meet its growing electricity demands, India needs to add a grid network as large as Europe’s over the next two decades. Also with the aim of carbon neutral emissions, a better grid infrastructure is needed.

ABB Power Products follows a January to December financial year.

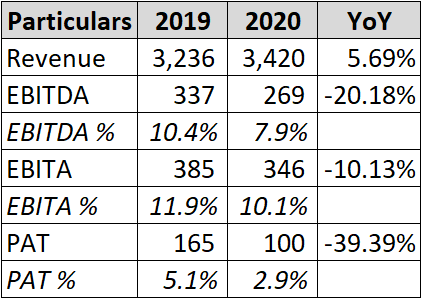

- The EBITDA margins shrank from 10.4% to 7.9% because of gratuity costs and business restructuring costs

- Despite a de-growth of -41% in the June 2020 quarter, the 2020 revenues ended up 5.6% higher than the 2019 revenues

- The company has high royalty payments ~ 5% of revenues; this significantly impacts margins as the company mostly can expectedly make margins in the 8% to 10% range

Q1FY21 numbers

- The revenues grew 24% on a YOY basis; the EBITA improved from 7% (Q1FY20) and 6.3% (Q4FY20) to 7.4% in Q1FY21

- The new orders de-grew by 9%; However, excluding a one time large order of Rs 282 Crores in Q1FY20, the new orders grew ~ 30.06% (Rs 652 Crores in Q1FY20 vs Rs 848 Crores in Q1FY21)

- The total order book at the end of Q1FY21 stood at ~ Rs 4,777 Crores. Around 50% of orders are from utilities, 27% from heavy industries and 23% from transportation infra.

India contributed 5% of ABB’s power grid business EBITA. Given the transaction price, the valuation of the Indian business works out to ~ Rs 4,100 Crores.

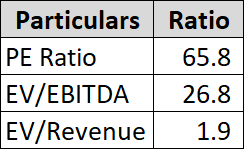

The 2020 revenues and EBITA stood at Rs 3,348 Crores and Rs 195 Crores. The EBITA margins fell from ~9% in 2019 to 5.7% in 2020. At current enterprise value of ~ Rs 7,050 Crores, the stock trades at 37x EBITA and 26x EBITDA.

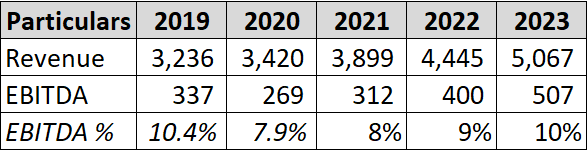

Given the expected GDP growth rate of 9% to 12% for FY21 to FY24, we believe that the Government will spending heavily on infrastructure. The revenues can grow at ~ 14% CAGR over the next 3 years (CY21 to CY23). The EBITDA margins were lower in 2020 to due restructuring costs and higher employee expenses; the EBITDA margins should consolidate around the 10% mark. In 2021 itself, the employee expenses should reduce to 8% from 10% of revenues.

The current multiples at are a significant premium to the multiples at which the ABB - Hitachi transaction happened. However, India is a small part of ABB’s global power grid business and has higher expected growth rate in the coming years versus the larger markets.

The current multiples look stretched because of the pressure on the margins. The market is discounting a return back to ~ 10% EBITDA margins in the coming quarters. Assuming a Rs 500 Crore EBITDA by CY23; then for the stock to double from current levels, it would have to command a 30x EV/EBITDA multiple in 2023. Companies that rely on heavy capex spends don’t usually trade at EV/EBITDA multiples of 20+ but if the sector is an upcycle then the valuations can expand. The revenue growth and margin expansion too could surprise on the higher side (Honeywell went from 11% to 19% operating profit margins in 5 years).

|

| Momentum on its side |

The stock has strong momentum on its side and has delivered close to 70% gains over the past 5 months. Given the bright prospects over the next 3-5 years, investors who want good stocks with momentum can keep this stock in the watchlist. Is this a value stock? Probably not! The valuations are rich and a lot of good news has been factored in.

Disclaimer: The above post is not to be constituted as a recommendation to BUY OR SELL the discussed stock. This post is just a aggregation of publicly available data.

No comments:

Post a Comment